Did you know that looking for a new job makes you a target for thieves?

Here’s how I know.

Denise had been unemployed for nearly eight months when she contacted me to re-do her résumé. As a sales rep for a major cosmetics company, she had enjoyed a good salary, super working conditions, a travel allowance, and great benefits.

When we revamped her resume, she started getting interviews.

One day she received an email from a credit agency she’d never heard of, but one that claimed to represent one of the companies where she applied. The message asked that she complete online forms, including information like Social Security number and bank account information. Denise knew it was common for employers to run credit checks, so she completed the forms because they looked so convincing and they guaranteed privacy and security.

Big mistake.

Big mistake.

You can guess from the title of this post what happened next. Her personal information was stolen and the scammers were able to apply for new credit cards in her name. Fortunately, one of her credit card companies called to ask why she wanted a second card, and she was able to notify local police who told her how to file for fraud and protect her other cards.

In the last year, social media scams and phishing attacks have increased 125%. The thugs know that jobseekers make good candidates because they are already accustomed to being asked for personal information.

These scammers don’t limit their target victims to any particular demographic. People of all ages, income levels, and educational backgrounds have fallen into their traps. Don’t fool yourself into thinking you are immune because you’ve heard warnings about identity theft, stolen credit cards, and hacked accounts. These thieves are pros.

After Denise’s brush with scammers, I decided to do my homework so I could alert other clients. I discovered there are three common ways job scammers work.

Work-From-Home Scams

One of the most common rip-offs geared to job seekers is the one that promises that you can make lots of money working from home.

Today plenty of people already work from home. About 30 million folks operate out of their home office at least once a week. Surveys that test worker satisfaction indicate that many people would trade a lower salary for the flexibility of telecommuting. So it’s no wonder that work-from-home scams are thriving.

Some work-at-home scams involve pay-to-play schemes. You are asked to send money in exchange for a special kit, supplies, or software that you can use to earn money working from home. Sometimes the company promises to reimburse you when you are hired, but the job offer never materializes. Or the scammer might ask you to pay a subscription fee to access a website or a list of work-at-home opportunities. Run, do not walk, away from these offers.

The most common scam you’ve probably heard about is when you’re asked to deposit a legitimate-looking check and then wire money or buy products online, and then you’re left holding the bag when the check bounces. Your bank will require you to cover the full amount of the check plus bank service fees.

In a similar work-at-home scam you will be actually set up with supplies you’ve purchased to assemble, with the promise that you will be paid for your tasks. Common tasks are stuffing envelopes, processing invoices or rebates or other papers, taking online surveys, or assembling small parts by gluing or sewing. But when the finished work is submitted, it’s rejected as “not being up to standards.”

The most dangerous scam along these lines happen when the “employer” requests payment for something in the form of a pre-paid Visa card. It is very difficult to recover money lost to a fraudulent transaction that used a pre-paid debit card because there is often no paper trail and the money transfer is immediate.

Some work-at-home business opportunities promise a refund if you’re not satisfied. However, victims who’ve tried to get refunds are usually not successful.

Identity Theft

We’ve all been warned about identity theft. One of the biggest areas of growth with identity theft is tax theft – when a thief uses your Social Security number to file an income tax return and obtain a refund.

Or, your Social Security number may be sold to an undocumented individual. When that person uses your Social Security number to get a job, his employer may report that person’s income to the IRS, so when you file your tax return and don’t include those earnings, the IRS will come after you.

If your identity has been stolen, and you receive a notice from the IRS about unreported wages, or that your return has already been filed, contact the IRS Identity Protection Specialized Unit at (800) 908-4490.

Be cautious when you are asked to provide your Social Security number in a job search, especially if it’s asked for in an application or online form. Carefully check out any companies that send you an unsolicited job application or offer before providing any personal information, especially your Social Security number.

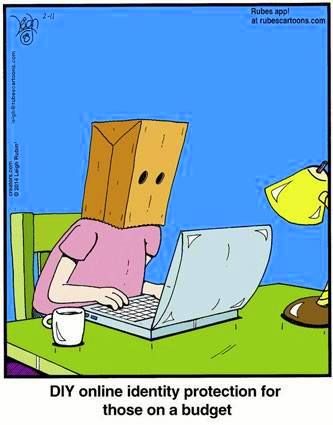

My personal policy is to never send a SSN online unless it’s a legitimate government site. The safest way is to use a secure landline.

Also, be careful of how much personal information about yourself you disclose on social media sites. People up to no good can use that information to answer “challenge” questions on your financial accounts, getting access to your money. Even saying “Happy Birthday” to your mom on Facebook could provide a mother’s maiden name to these thieves.

The Bait-and-Switch Job Offer

Scammers will put together job postings that look like they’re from real companies. They’ll use the real company’s name and logo, but the e-mail address it comes from is from a Yahoo! or Gmail account. Some of these scam opportunities are also coming through disguised as LinkedIn connection requests or job postings. The lesson here is that you have to look closely at the details in order to tell that it’s not a legitimate opportunity.

Some scammers don’t bother faking a job opening with a major company. Instead, they’ll invent a fake job to hook unsuspecting jobseekers. This technique is popular because posting the job costs the scammer little or no money, and is very effective. A scammer can post dozens or hundreds of listings for free on Craigslist. If they get even a small percentage of folks to fall for the scam, they can make tens of thousands of dollars.

Bait-and-switch offers can exist on any niche job board, or even the big job posting boards. The listings collect résumés to build their database of candidates and email addresses. On Craigslist, Monster, or CareerBuilder, these scams might be posted to get leads for multi-level marketing opportunities, or it might be to build a database of jobseekers so they can sell that.

These scams can be quite elaborate. You may be asked to participate in several phone interviews, or complete a pre-employment test. Being asked to jump through several hoops is one way to lure you in and build confidence and hope.

How to Avoid Being Scammed

Research is the best defense you have against getting scammed. The more you know about how crooks work, they less likely you’ll be victimized.

- Google them. A simple search of an internet address or company name will help you determine if you’re pursuing a legitimate opportunity. You may learn that other folks have been targeted with a scam originating with this address or name.

- Proofread. Job postings and sites with lots of errors, misspellings, or typos are often scams.

- Check duplicate listings. When you search on Google for a job posting, see if the identical ad comes up in numerous other cities. If it does, it may be a scam.

- Check locale. Countries that have a high fraud rate are Belarus, Estonia, Ghana, Hungary, Indonesia, Latvia, Lithuania, Macedonia, Malaysia, Nigeria, Philippines, Romania, Russia, Singapore, Slovak Republic, Thailand, Uganda, Ukraine and Yugoslavia.

- Be objective. Act cautiously when receiving job offers that sound too good to be true. If you receive an email out of the blue with a job offer, investigate it thoroughly before responding, or simply delete it.

- Stay private. Be mindful of the details you share on social media. A lot of the information you put on social media related to your job search is public. If you put out the word that you need a job fast, it will make you a bigger target.

- Invent new passwords. Do not use the same password for multiple sites. Use passwords that contain letters, numbers, and symbols. If you set up a username and password for accessing a bogus company website, and then use the same password for your financial accounts online, scammers can access them without your knowledge.

- Monitor your credit history. Request your credit report from the three national service providers (Experian, TransUnion, and Equifax). Obtain yours through www.annualcreditreport.com. You are entitled to one free copy of your credit report every 12 months from each credit reporting company. One sensible approach is to pull a report from one bureau every four months, so you receive all three reports for free in a calendar year. Staying on top of your record has an additional advantage since some companies check your credit when you apply for work. You can also sign up for an ongoing credit monitoring service, which will provide you with email alerts if identity theft or fraud is suspected on your accounts. Some credit monitoring services also include identity theft insurance, which will reimburse you for time and money spent recovering your identity.

Staying Safe

Having a plan is an excellent defense. The more focused you are on your job goal, the less desperate you’ll feel. Having assistance in developing that plan is going to help you be methodical and confident about working that plan.

Here’s the kind of assistance I am talking about:

- Work with a pro. That may involve signing on with a career service professional or career coach to develop your plan. Having a professionally done résumé should be part of your plan.

- Surround yourself. Get help from a resource in the community, like a workforce development office, or help from churches and community organizations that offer assistance.

- Reach back. Align yourself with your college or university’s career service office. LinkedIn and professional organizations can help you contact colleagues and classmates as well. Be proactive and network with people you know and trust.

If you feel less desperate, you won’t chase opportunities or respond to unsolicited opportunities. People are more likely to be scammed by things that come randomly into their e-mail inbox than things that they pursue within their own network and support team.

Avoid Being Re-Victimized

Some scammers sell lists of people they’ve stolen from. The second round of scammers comes in to help you recover the money you’ve lost in the original scam. Instead, you’re re-victimized.

Unfortunately, the kind of folks who are perpetuating these scams don’t care about people. They care only about money. They’re determined to separate you from your money any way they can.

If you have been scammed, report the crime. Contact your local police and the Federal Trade Commission at www.ftc.gov/complaint. If you have provided access to your financial information, contact your financial institution and ask for help in eliminating the scammer’s access to your account. You may have to close your account and set up an alert on a new account. For clarity’s sake during this process, it’s a good idea to keep a written log of names and phone numbers of everyone you’ve spoken to, and keep copies of all reports you file.

Being aware of the all they ways scammers operate will help you keep from becoming a victim of cybercrooks.